Crypto is derived from the Greek word kruptos meaning hidden. Indeed, it stays concealed from ordinary people as some technical knowledge is warranted to start with the crypto universe. So let’s take a deep dive into the crypto world to reveal its subtle details.

What is Cryptocurrency?

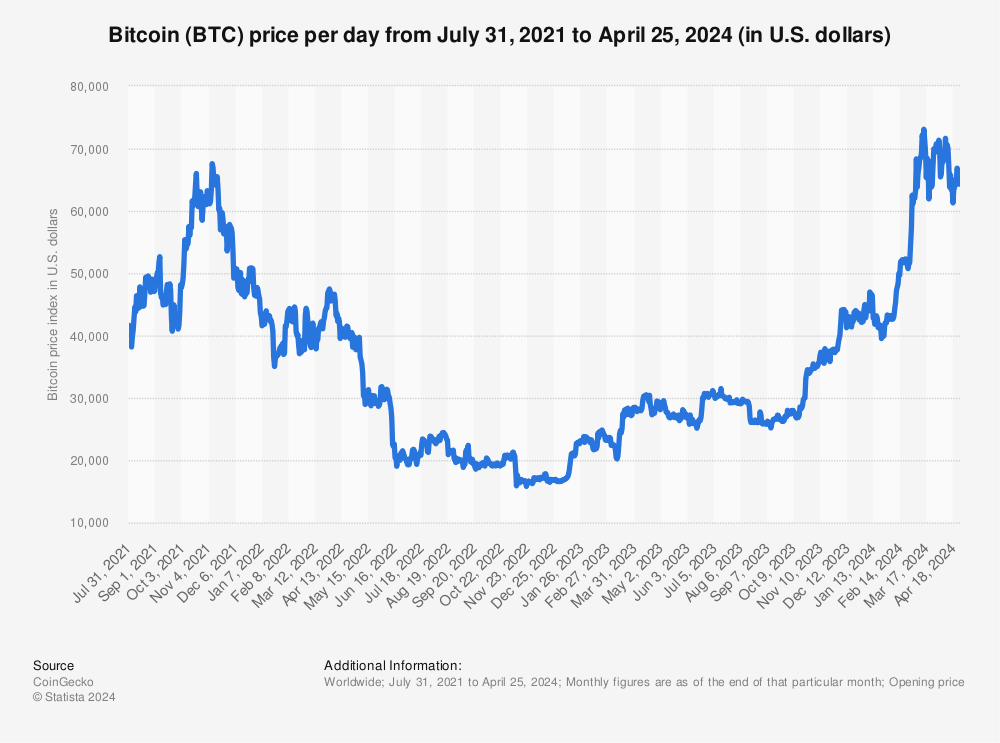

This is the one that started all of this, bitcoin, the biggest of all cryptocurrencies. It’s sort of a digital (or virtual) coin, currently valued at USD 45,597 a coin, down from USD 63,569 on 14th April 2021. There were 5,840 cryptocurrencies as of August 2021, according to Statista. Most popular are Bitcoin, Ethereum, Cardano, Tether, Binance Coin, XRP, etc. You can check the complete list with details like their market cap, current price, etc., at CoinMarketCap. For simplicity, I’ll sometimes use Bitcoin to refer to cryptocurrencies in general and bitcoin to mention it as the individual currency. Bitcoins are digital coins managed at decentralized digital ledgers called blockchains. They are circulated (mined) and used without the centralized control of any public or private institution. It’s like the people’s money. Ordinary people like us are responsible for making it a reality. Its base technology, blockchain, ensures its secure operation. This same technology underpins the non-fungible tokens as well. Blockchain is a digital database that keeps a permanent and immutable record of every transaction on it. Additionally, blockchain verifies the transactions via network consensus. The nodes do this verification process to validate the ongoing transactions. This operation also mines new bitcoins for circulation. Interestingly, unlike fiat currencies, there is a circulation limit to most cryptocurrencies. For instance, only 21 million Bitcoins can be mined. This fact turns cryptocurrencies into a powerful hedge against inflation. The only factor that can sway the value of a digital coin is public speculation. It can cliff-dive by a sell-off or skyrocket with people lining up to use it. Take a look at the bitcoin price variations since 2013: Presently, it is used as more of an investment opportunity than a regular currency. But it is getting mature. More and more platforms are pledging their support for cryptocurrencies by accepting them. From Microsoft, Paypal, Overstock to Burger King, we see people increasingly making payments in these online currencies. So, it’s about time you knew it inside out. Taking one at a time, let’s jump into the crux of this article, cryptocurrency mining.

What is Cryptocurrency Mining?

There are numerous cryptocurrencies out there, and they slightly differ in their mining protocols. So, we’ll stick to bitcoin, and in this segment, we will further discuss bitcoin mining specifically. Crypto mining brings new coins into circulation and authenticates ongoing transactions. It uses cryptography to check counterfeiting and double-spend. To understand mining, first, we’ll have to know how blockchain works. Suppose you’re using bitcoin to purchase dinnerware at Overstock. What will you do? Simple, add your product to the cart and check out with bitcoin as the preferred payment method. Behind the scenes, your transaction goes into the verification queue with other entries waiting to be verified and gets added into the next block. This latest block keeps taking entries until it is full. Each block is limited to 1 MB of data at present. Formation of a block and verification of the transactions within carries a reward for the miner. After all, they use their resources (read electricity, equipment, etc.) to solve complex math problems to get your transaction onto the blockchain. This ‘complex math problem’ refers to finding a 64-digit hexadecimal number, called a hash. The incentive is usually paid in the cryptocurrency itself. But not every miner gets paid. Only the first one to come up with the correct hash receives the reward. Others get nothing but an electricity bill. So, the process is risky and occasionally fruitful. And, it can be a time waster if you don’t have powerful computing at your disposal. While we have an overview of the crypto mining process, it’s time to uncover some hidden technical details. And, first comes the foundation of blockchain security: hash.

What is a Crypto Hash?

As mentioned above, you need to find the hash to complete a block worth of transactions. A hash looks like this: Every block has a unique hash associated with it. It’s always a 64 digits number, no matter the transaction data. Any alteration of a single transaction will generate a different hash. So, transactions once recorded are tamper-proof. Additionally, every block’s hash is related to the hash of its predecessor block. This adds to the immutability of the blockchain. Because any effort to change anything in a single block will change the hashes of all the subsequent blocks, this will eventually start a fork, a different blockchain, starting from that exact point of change. Based on the length of the chain, it can require tremendous computing power. This process is so tedious (and pricey) that it can become pointless to gain anything out of it in the end. Not all forks are initiated by bad actors. Few are also system-generated forks, which can be seen as upgrades. For instance, the London Hard Fork on the Ethereum was legit. It took place on Aug-05-2021 12:33:42 PM +UTC, from block no. 12,965,000. You can find the history of all forks on the Ethereum blockchain here. This rock-solid process of securing blockchain transactions with hashes is called cryptography.

How do Crypto miners find the target hash?

The target hash is a numeric value decided by the network after every 2,016 blocks. The aim is to maintain the mining difficulty such that a block gets mined every 10 minutes on average. It is the value a hashed block header is targeted at. Block headers are 80-byte data string that acts as the ID of individual blocks. It contains information specific to a block, like bitcoin version number, the previous block’s hash, timestamp, etc. So the mining process is nothing but running algorithms (SHA-256 hashing algorithm for bitcoin mining) to hash the block headers to a value lower than the target. And the first one to do it wins the block reward. It’s like winning a lottery. Back in 2009, mining was easy. You could have mined with your personal computer. Interestingly, as Bitcoin gained popularity, its value surged, and more people jumped into mining–professionally. This increased the mining difficulty, and at present, you need nothing less than dedicated machines with high processing capacity to earn the block reward. But even if you don’t want to invest substantially in mining equipment, there are options for you. To know this better, let me discuss various types of mining.

Types of Mining

Based on the number of participants, you can divide mining into Solo and Pool. It’s termed CPU mining or GPU mining as per the primary equipment used in the process. But, if you’re using rented infrastructure, then it’s called Cloud Mining. Let’s explore each one of them.

#1. Solo Mining

Solo mining, as the name might suggest, is mining independently. It’s the most costly affair, but at the same time, you earn the exclusive reward for your efforts. Notably, you miss sharing the profits of other miners as well. Mining equipment takes a lot of power. They create a constant humming of hundreds of chips running to find the required hash faster than every other miner–solo and pool–on the planet. So, you’re looking at considerable investments to set up a cool, ventilated, large, and remote space to install your mining farm. Add to this the sky-high cost of mining rigs, and your wallet may start to feel lighter already. Check out this video, and it’ll give you an idea about the forces you’re up against when hunting for the precious block reward:

The good news is, this cut-throat mining atmosphere is only valid for bitcoin and some other established currencies. But you can mine some other (read new) crypto coins quite profitably at a fraction of investment.

Solo Mining Profitability

For illustration, I’ll assume you live in California, USA. Location is essential for calculating electricity bills and the general feasibility of mining as a profession. Now you’ve two options for the equipment. Either go for a general crypto mining rig or buy an Application-Specific Integrated Circuit (ASIC) Miner. A crypto mining rig is excellent, and it’s like a pumped-up regular personal computer. It deploys lots of graphic cards to get the job done. You can do your daily digital chores, and the mining will take place in the background. But it won’t be as fast as with ASIC units. Anyways, check out this video for building a mining rig with a bunch of GPUs:

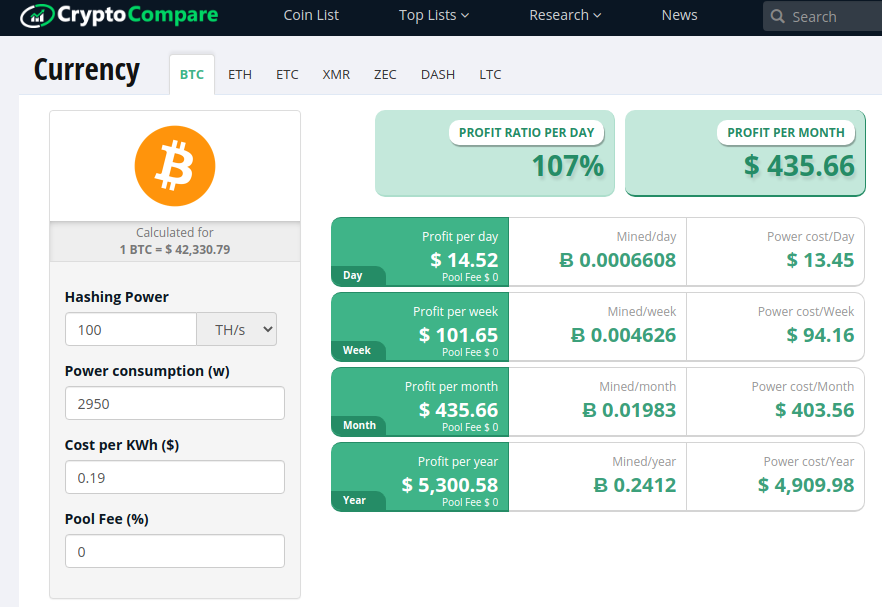

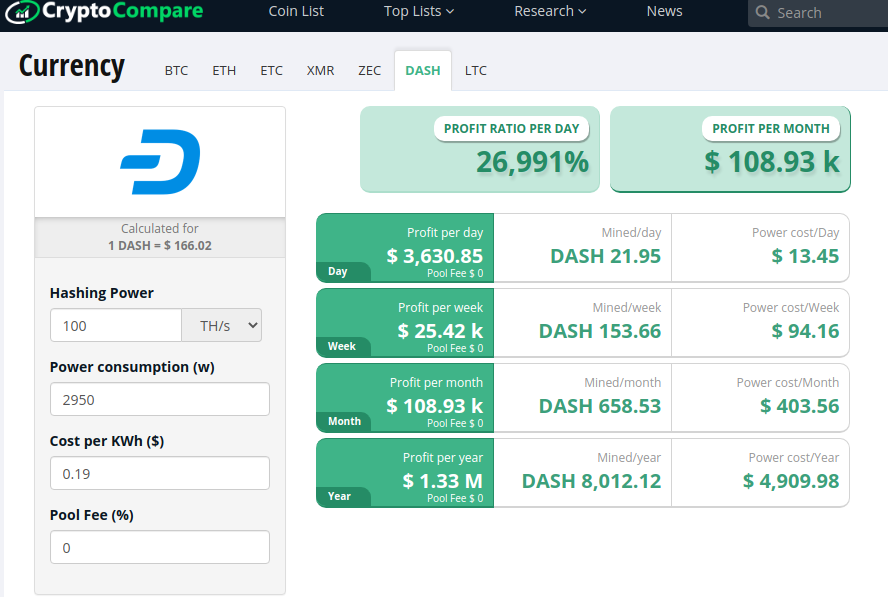

In addition, you should look through this article before starting with your mining rig. Next and the professional option is ASIC miner. They have dedicated mean machines invented (assembled) for only one purpose–mining. So for this example, I’ll take the Antminer S19j Pro 100TH/s mentioned above. It has an incredible 100 TH/s hashing rate (mining speed), and it’s priced at USD 9,300 at the time of this writing. This ASIC miner has 2950w power consumption. And, since we’re mining solo, I’ve set the pool fee as zero percent. Now to calculate the profit, I’ll use CryptoCompare. This is the output: Now, the median income in California in 2019 was roughly 32000 USD. Going by this analysis, you’ll need 74 (divide 32000 by 435, monthly profit) of such ASIC units to touch the average living standards in California, USA. It’ll be around 74*9300 = USD 688,200 on the ASIC miner bill. Remember, we haven’t yet added the cost of real estate, ventilators, cooling, etc. In short, it’s VERY costly–if you’re mining Bitcoin. Let’s go through this calculation once again for Dash (another cryptocurrency that use X11 algorithm) this time. In this case, that single ASIC unit pushed you over USD 100,000 in monthly profit. So yes, mining can make you a millionaire, but only for the right choice of coin. Additionally, include overhead costs for a complete financial picture.

Technical Setup of Solo Mining

These are the tasks to start mining solo. Heads up, this is a bit technical stuff. But, you’ll get there if you take one step at a time. a) Configure a full node: Full nodes are the primary stakeholders of the bitcoin blockchain. They help in validating transactions along with other full nodes in the network. b) Creating a bitcoin.conf file: This file helps in modifying the full node per your details. Afterward, you save it to the default bitcoin directory. c) Install any bitcoin mining software: You have options like CGMiner, BFGMiner, MultiMiner, EasyMiner, etc. d) Launch the mining software as per the details entered in the bitcoin configuration file.

Just keep in mind that mining depends on luck as well. It’s not a definite milestone to achieve with powerful hardware. You may come home empty-handed despite sophisticated machines buzzing by your side. This holds especially true for solo miners. Nevertheless, it’s not always feasible to invest this much. Keeping this fact in mind, let us jump over to an economical alternative, pool mining.

#2. Pool Mining

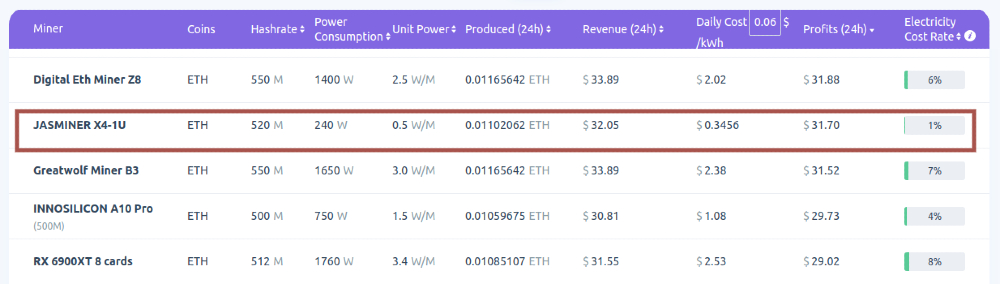

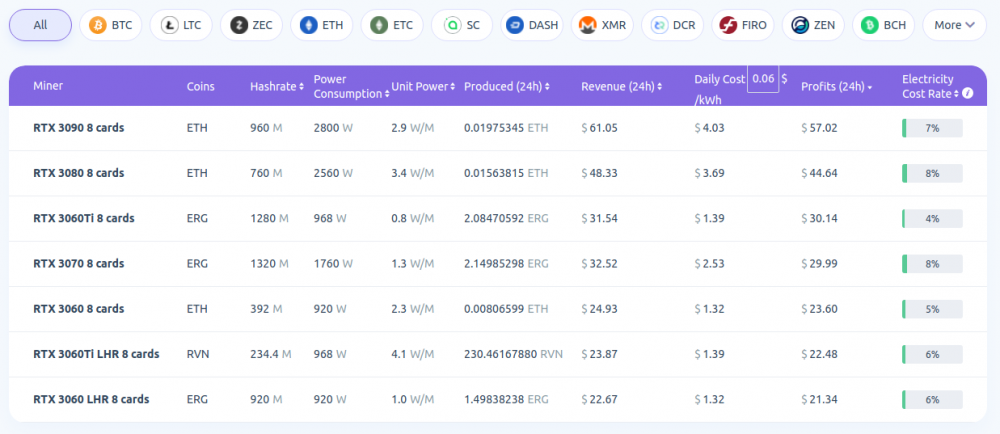

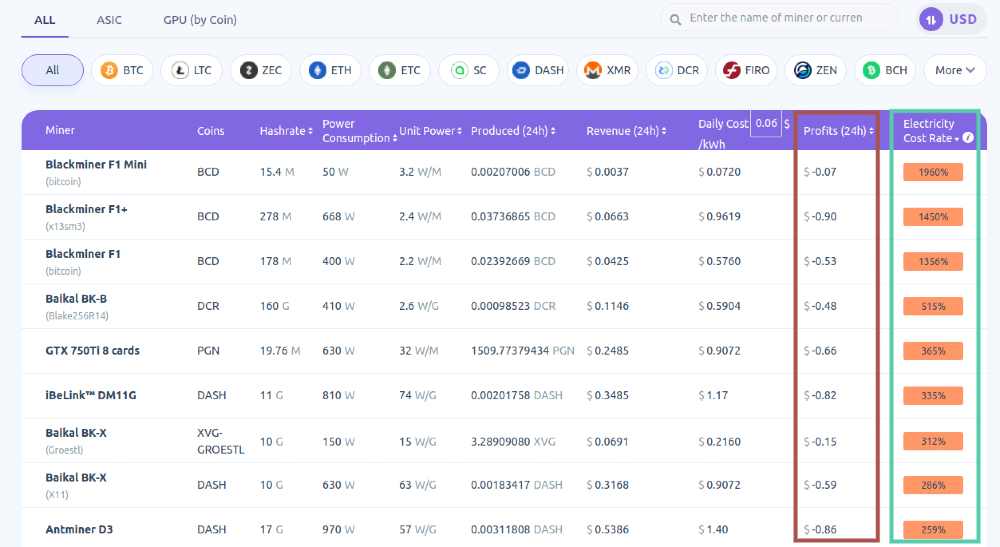

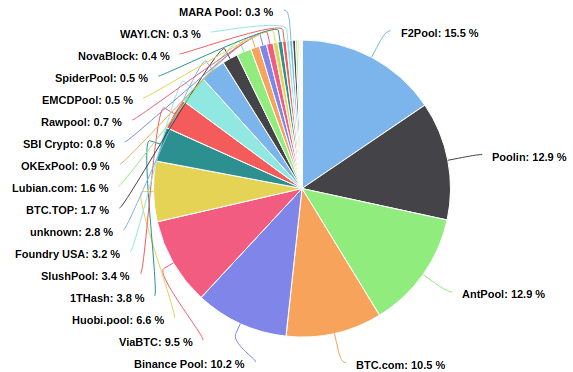

Pools are like a group contributing to the mining process. You take part with your limited computational prowess and get the rewards according to your hashrate. For example, you can join F2Pool, the biggest mining pool at present. Take a look at some of the miner’s profit with their lowest of hashrates at F2Pool: This miner ‘JASMINER X4-1U’ with his 520 M/s hash rate is making $31.7 a day. But even that one is using an ASIC miner, although a less powerful one. So your profits will still be lesser if you’ll only use your graphic card for mining. But you can churn good numbers if you’re using multiple GPUs like these miners: Just keep in mind to figure out the electricity cost in your location, as those bills alone can outpace your mining profits and can put you at a loss. Check this out: To start with pool mining, first, you need to select the pool to join. Few critical factors in weighing up your options are pool fee, reputation, payment cycles, and pool size, among the others. It is essential to consider everything and make the right choice. Some of the biggest pools (in the last one year) by the percentage of block mined were: Image Credits After selecting the pool, you need to visit their website for further setup instructions. Like with solo mining, you can also use CryptoCompare for pool mining. The only thing to change is pool fees (usually 1% to 3 %), according to the pool you decide to mine with.

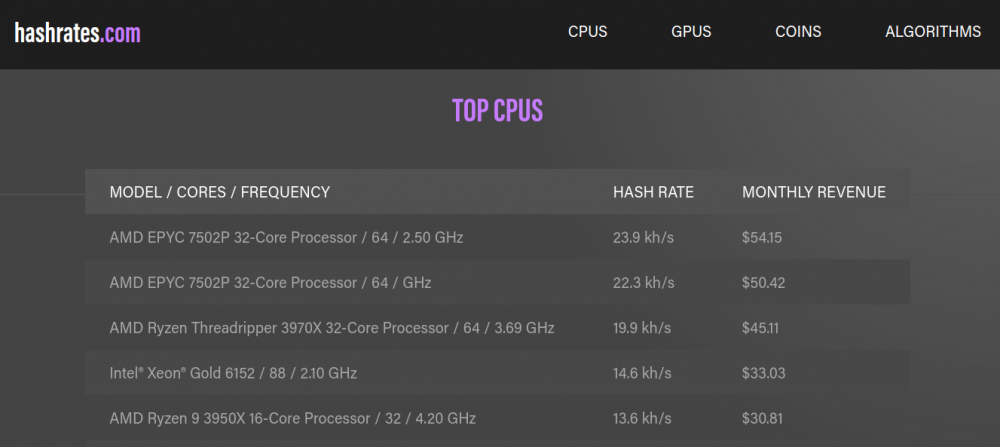

#3. CPU and GPU Mining

The only difference in these is the hardware used for crypto mining. CPUs are cheaper than GPUs. However, they don’t mine nearly as well. Image Credits So, CPU mining is not recommended if earning a block reward is on your radar. At present, having multiple GPUs lined up in your crypto mining rig is a bare minimum for a profitable mining endeavor. However, it can be tried by new entrants in the crypto world without any gigantic investment upfront. The setup is similar for both CPU and GPU mining. First, choose and set up a crypto wallet. Then, download and configure any mining software for your desired cryptocurrency, and you’re good to go.

#4. Cloud Mining

With Cloud Mining, you sign a contract with a cloud miner (like ECOS or Genesis Mining), and they lend you their mining infrastructure. You don’t care for the hardware, software, and maintenance hiccups. You pay a periodic fee and mine the coin of your choice based on the availability at your cloud miner. It’s like using a paid Gmail. So ultimately, cloud mining is a simple affair for the non-tech-savvy-rich who want to invest in the cryptocurrency mining space. In essence, you invest in mining operations fully managed by others and reap the rewards based on the hashrate purchased with the contract. Notably, you pay your dues beforehand even if you don’t make any profits. Because crypto is a volatile market, and your contract doesn’t care a thing about that.

Crypto Trading

Mining is not the only way to own crypto. You can also trade your fiat currency for these. For trading, you have to register at any crypto exchange and purchase cryptocurrency of your choice with your government-issued currency. Some exchange portals also permit exchanging between crypto coins. But mining appeals to crypto enthusiasts unlike anything else. Not only do they earn bitcoin this way, but they also contribute to the sustainability of the network. They make the blockchain more secure and keep the transactions going. Without mining, there won’t be new coins. Additionally, they do have a say in any change in network protocols.

Final Words 👨💻

In short, cryptocurrency mining is for the technically skilled. It’s an unpredictable market. So, better test the waters thoroughly before jumping in with your hard-earned money. Conclusively, try mining smaller coins before going for the big fish. And, do not try to mine bitcoin (or similar coins) with a single GPU or CPU. You would be wasting your time and electricity, in addition to pushing your equipment out of their life cycles. Consider every factor – land, electricity, atmosphere, hardware, software, etc., before starting in this strange world of computer currencies. Many are making fortunes by crypto mining. And with the right knowledge base and resources, you should be able to achieve success.

![]()